What's a Home Appraiser Do?

Professional home appraisers estimate price valuations for property. With these estimates in hand, lenders, homeowners and investors can make informed decisions. Appraisers take into consideration local property trends and the condition of each home. Be advised that home appraisals are only estimates, which might not match your actual home price discussions.

Identification

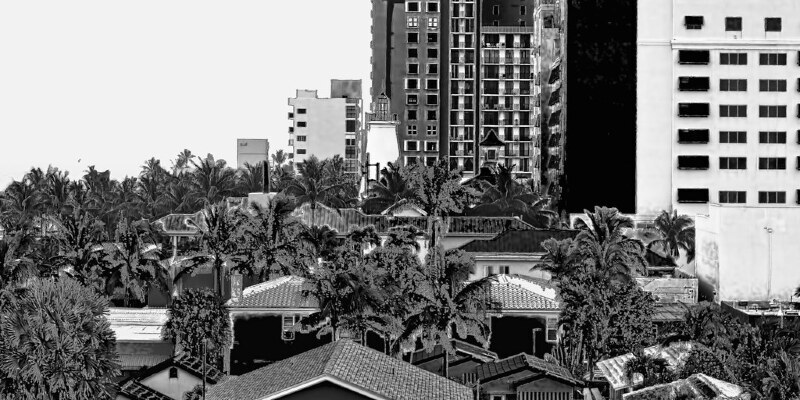

Real estate appraisers analyze sales prices for comparable properties, or comps, in a particular neighborhood. It is logical to anticipate similar homes of the exact same subdivision to bring nearly equal prices. The home appraisals of a particular area are mainly affected by the supply and need for real estate. Neighborhoods with high population densities and steady jobs creation are synonymous with strong property values. Land area is then in limited supply, as potential buyers covet housing that’s near employment centers. Conversely, similar homes appraise for lesser value in rural communities and troubled areas, where space is plentiful and fewer job opportunities exist.

Features

Appraisal values are also contingent on the specific characteristics of each home. Larger, well-maintained possessions are attractive for potential buyers and command higher prices. Aesthetics, such as crown molding, stainless steel appliances and exposed brick, and additionally improve value. Homes in disrepair, nevertheless, appraise at lower prices. Prospective buyers devalue these possessions because they frequently require expensive maintenance and repair work. Older homes may require updates simply to meet building codes.

Factors

Property appraisers are familiar with the industry cycle of growth, recovery and reduction. Home values appreciate amid periods of economic expansion, when jobs have been created daily. At that point, investors and home builders start developing new possessions to meet increased demand. In time, price gains make homes unaffordable for most buyers, while the supply for new homes operates high. At that point, property prices frequently fall on grounds of poor demand and high supply. Finally, consumers and investors return to buy cheap property, and the cycle begins anew. Real estate appraisers also notice that demand for their solutions parallels this economic cycle.

Types

Real estate appraisers help individuals organize strategy. High appraisals may serve as motivation for individuals to sell property and take profits. Conversely, low appraisals attract value-conscious buyers who exploit the market for cheap real estate. Investors can then add to their property portfolio, while maintaining current properties for lease income. Municipal authorities run their own assessments for real estate tax purposes. Property taxes are calculated as a percentage of assessed value and aid city officials provide critical services, such as public colleges.

Warning

Real estate transactions are often subjective and based on emotion. By way of example, you might want to move quickly to have a job in a new city. At that point, you’re more likely to take a promising offer lower than appraised value. Sales prices may depart significantly from evaluation figures amid downturn, when your home has to compete against cheaper foreclosure properties.